Simple fact is that prevent of your own month, and you are sifting via your expenses after you spot your own Credit Card report. Minimal number owed captures your eyes – a figure that looks like a magic bullet for the instant economic filters. But have your ever stopped available what it is lays trailing that one and how it has an effect on your financial fitness?

This web site is set so you can unravel the concept and requirement for minimal matter due within the Mastercard declaration. We’re going to diving towards its calculation, find the invisible effects away from continuously opting for which highway, and you may show how it normally contour debt upcoming. There is the capacity to take control of your Credit card intelligently, making sure the decisions fall into line with your enough time-title financial really-becoming.

Meaning of lowest amount due into the Bank card

Knowing the minimal fee during the a credit card is a must so you can keeping a healthier borrowing from the bank profile. It means at least matter you could spend to avoid later fees and ensure your account remains beneficial toward financial. It sum can be computed once the a fraction of any a fantastic equilibrium, inclusive of people amassed appeal and you will relevant charge. Recognising the significance of make payment on charge card minimum due is essential, because not just makes it possible to avert charges but also obtains their credit rating, acting as a beneficial foundational step-in your own greater monetary administration means.

Let’s consider a tiny example to own quality. Imagine you may have credit cards with an outstanding harmony from ?ten,000. The Charge card business need a credit card minimal fee from 2% of the a great balance. Thus, your minimal percentage due is dos% off ?ten,000, and this amounts to help you ?200. not, this does not mean your whole equilibrium disappears. The remainder ?9,800 tend to carry-over to another charging you cycle and can accrue focus according to the card’s words. Of the skills this, you can most readily useful manage your money, making certain your avoid unnecessary charges while keeping your credit rating match.

Calculate minimal count owed on your Credit card

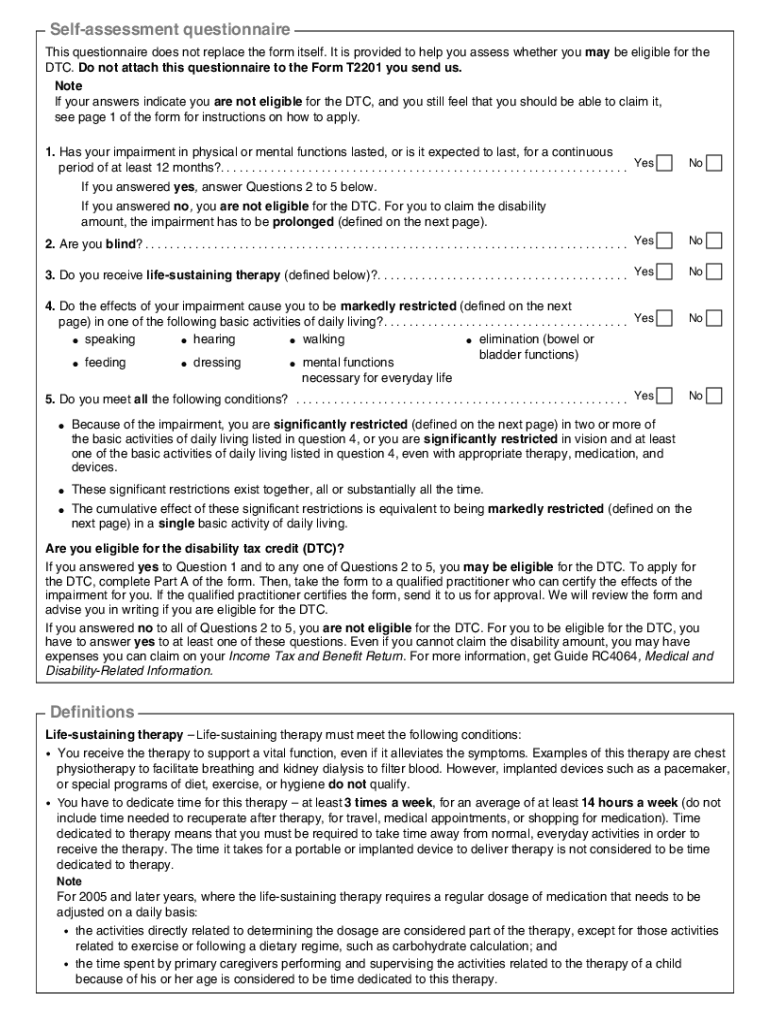

Teaching themselves to calculate Charge card minimal due is key getting active monetary management. Minimal due is generally determined just like the a share of one’s overall a great balance, and any applicable costs otherwise costs. Let me reveal an extended desk one illustrates certain circumstances:

Note: The above table try an enthusiastic illustrative example. The true computation may differ based on their Credit Card’s terms and conditions and you can requirements.

Great things about make payment on minimum matter due on Handmade cards

Make payment on minimum amount owed on a credit card may appear including a small step, it retains extreme pros, especially in controlling your financial health insurance and credit standing. Let me reveal a more detailed research:

- Hinders late percentage penalties: By paying the financing Card minimum balance, your stop hefty later payment costs. This type of charge can very quickly collect and increase debt burden.

- Keeps your account inside a good reputation: Constantly make payment on minimal owed ensures your bank account reputation remains self-confident. This really is critical for keeping a healthier experience of your Borrowing Bank.

- Suppresses negative effect on credit rating: Later costs or overlooked costs normally seriously effect your credit rating. Paying the lowest owed helps protect your credit score away from particularly negative impacts.

- Facilitates borrowing from the bank utilisation government: By continuing to keep your bank account from inside the a condition, your control your borrowing from the bank utilisation ratio ideal, which is a button reason for deciding your credit score.

Risk of paying the lowest matter owed

If you’re make payment on minimal amount due into a charge card can end up being a temporary save, its vital to comprehend the threats from the that it behavior. Paying just the minimum owed can lead to multiple economic challenges.

-

http://paydayloancolorado.net/raymer/

- Enhanced interest costs: Among the many risks ‘s the accumulation of great interest. Credit cards are apt to have high-interest rates, and also by expenses precisely the minimal, much of your fee goes with the focus instead of reducing the main count. Throughout the years, this may lead to you purchasing a whole lot more compared to the new amount borrowed.

- Extended obligations months: Once you pay only the financing Cards min count due, you might be basically extending that time it will require to repay the obligations. This extended financial obligation may become a long-title financial weight, and come up with gaining your own almost every other financial specifications tough.

- High borrowing from the bank utilisation proportion: Constantly holding a leading harmony on your Charge card grows your own borrowing from the bank utilisation ratio, that’s a key reason for determining your credit score. A leading credit utilisation ratio is adversely impact your credit score.

- Quicker creditworthiness: If for example the debt is growing over time, it will connect with the creditworthiness. Lenders and you may creditors may see you because the a top-chance debtor, which will make it difficult to track down finance or other credit contours subsequently.

End

Understanding the nuances from Mastercard costs, especially the implications out-of make payment on lowest count owed, is a vital experience in the modern financial land. You could potentially release yourself from the traction off obligations by paying over minimal. And if you’re seeking to blend savvy financial habits having satisfying feel, Axis Lender Handmade cards arise once the a persuasive possibilities. Axis Bank Playing cards appeal to the requirements of a modern existence that have impressive discounts, and also promote various positives one fit your own using habits.

Q: What is the minimal matter due into a charge card declaration?

A: Minimal count due toward credit cards report ‘s the smallest amount you might shell out from the due date to end later fees and keep maintaining your bank account in the an excellent condition. It’s a fraction of their full a great balance.

Q: What happens for individuals who pay only minimal matter owed on a charge card?

A: Investing only the minimal amount due contributes to stretched debt due in order to collected notice and a top credit utilisation proportion and will trigger investing more over time because of interest and charges.

Q: What the results are easily do not afford the Charge card expenses until the due date?

A: Failing to pay the financing Credit bill before the due date can also be sustain later percentage fees and extra attention charge and you will negatively effect your credit rating, which could apply to future borrowing potential.

Q: Does make payment on minimum owed apply at your credit score?

A: Expenses just the minimal due could affect your credit score over time, generally from the boosting your borrowing from the bank utilisation ratio, which is a switch factor in credit rating models.

Q: What’s the difference between minimal due and you may total owed?

A: Minimal owed ‘s the lowest number you can shell out to help you avoid penalties, because the complete due is the complete count your debt into your Mastercard, along with sales, desire, and you can costs.

Disclaimer: This article is getting information objective merely. Brand new viewpoints expressed in this article are personal and don’t necessarily make-up the brand new views away from Axis Financial Ltd. and its own team. Axis Bank Ltd. and/or perhaps the journalist shall not guilty of one head / indirect loss otherwise liability sustained because of the reader to take any financial choices according to the articles and you may information. Delight check with your financial coach prior to making one economic choice.