Once the removal of loan payments allows houses so you’re able to reallocate those individuals financing so you’re able to investment, lawmakers differ exactly how education loan debt forgiveness might impression racial wide range openings in the end

Mortgage forgiveness alter the rules in the center of the game. Individuals who sacrificed because of their education and those who sacrificed the brand new benefits of a studies are increasingly being requested to fund people that are taking advantage of the training it to begin with said was worth every penny on it to go into debt. This really is wide range redistribution where you are providing about possess-nots provide into haves.

What about establishing criteria for alternative certificates? Do we have some version of certification program whereby candidates you may confirm its capabilities?

Think about a world digital school? Number ideal lectures and possess TAs designed for questions. Children would have to truly attend labs, in case instructional and you may scientific professionals worked, you should be in a position to provide particular energetic options from the high coupons.

Think about exploring apprenticeship selection? Perhaps tax incentives you can expect to prompt employers to train professionals toward jobs. I know guidance and you can requirements must be lay, however, seriously specialists in new particular sphere you will definitely recommend programs one to perform at the least end up being worth an effective pilot program.

What about attaching federal investment in order to associations one to cap tuition grows? Maybe schools manage think again too-much university fees hikes in the event that performing this compromised its eligibility to own student loan currency, non-cash reputation, government investment, and/otherwise research features.

I’m not saying there was a simple answer, and I am certainly not saying We have it. I’m stating that flexible beginner personal debt merely facilitate people who are already benefitting throughout the training they decided to follow, but it does thus at the cost of people who failed to make use of men and women advantages, and you may do absolutely nothing to possess future people up against expanding university will set you back and you may uncertainty regarding the future condition of its mortgage preparations.

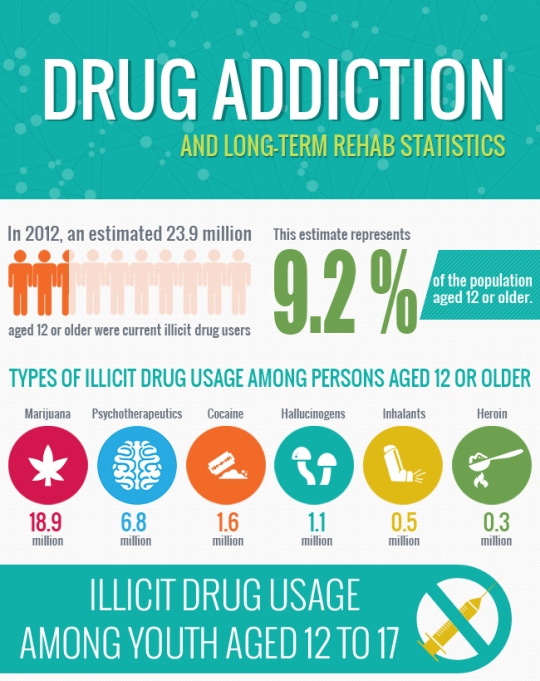

Private composed: I understand this is an area question into certain bond most likely on the Biden, but I discovered certain interesting data out of student loan loans and that is very inspired.

I came from a blue collar household (however, commitment blue-collar). Due to a number of most personal problems within my life, There isn’t loads of wide range. https://simplycashadvance.net/payday-loans-wv/ But more than half of the modest wealth I really do enjoys try generational through my loved ones (house it had at no cost 3 years before via the Homestead Act) and my during the-rules (Irish quarry owner among 50 % of the latest 1800s, young man who was an attorney, upcoming a beneficial descendant who had been a legal immediately after which my FIL just who went to private universities and you can wound-up regarding petroleum leasing business). I mentioned struggles, I had certain lifelines throughout the those individuals battles–zero, devoid of somebody purchase me a home, more like, such, accommodations whenever my existence got fell apart away from not as much as me personally, or a good ten year old automobile as i requisite an automobile so that you can work in their outlying society until We you’ll do a go on to a much bigger area. However, that was, virtually, homelessness vs perhaps not-homelessness.

Let me get this to a little more clear: We very own money-producing land worthy of $200k that was provided at no cost on my great grandparents. Performed it works hard? Definitely. Guess what? Studies have shown you to definitely certainly children, black colored feminine (a whole lot more student loans) spend much more time understanding than light dudes (faster college student loans)

More than half (53%) off white students sit-in college or university without having to sign up for any funds at all, but the 47% that do discover 54% of student loan currency.