When rates of interest try reduced or their assessment is actually high, it’s enticing to obtain a loan that is much excessively from that which you actually need. That imply you wind up overextending yourself and obtaining during the over your mind when the time comes to make repayments. This means if you find yourself planning to make use of your mortgage to spend to have university fees, prevent the temptation to slide during the a vacation even though you getting it is better-deserved. With an agenda and you may knowing your constraints are two extremely important steps into the in control and you will smart credit.

That’s it five easy steps all are it will take to ensure your house guarantee mortgage procedure can be as fulfilling and you can fret-100 % free that one may. Take minutes right now to begin, and soon you will be on your way to while making debt ambitions and goals come true.

- Batesville

To ensure that you dont end up in financial warm water, take the appropriate steps for how you’re make use of loan continues, also simply how much you should see the individuals wants and then stick with it

Because you shell out interest only as you wade and on what you pull along side first ten years, this new affluent, eg folks who are self-working, are able to use a house guarantee credit line to float time-to-go out expenses. Predicated on Janis Bronstein, a vp on FM Mortgage brokers, an excellent Hamptons, NY-oriented home loan broker, home guarantee can even aside rough costs and offer a connection some other intentions, such as for instance home improvements or auto orders. For folks who qualify, you could use a property guarantee personal line of credit to help you loans the acquisition of some other family if you find yourself seeking to offer your current family. To do so you really need to meet the debt to earnings ratio advice and you may downpayment assistance set forth of the the newest mortgagor.

Naturally, when you find yourself taking out a home equity financing, you don’t have a lot of money to expend for the big renovations

By the point later years is here now, very people have collected considerable collateral inside their residential property equity which can promote a significantly-needed financial support and additional satisfaction. Even if home security is just one item common by greater part of seniors, it’s often overlooked as a way to obtain finance to possess retired people. At the least part of that is due to the fact that house guarantee finance was mostly sold because loans for life expenses such as for instance wedding receptions, college degree otherwise home improvements, and never viewed as traditional automobile having helping counterbalance some of your expenditures from old age. One see has started to change now because old People in the us be a little more aren’t in addition to its home’s equity within their advancing years believe.

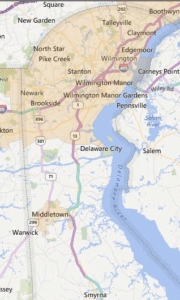

When you are improving your credit history and you can get, it’s adviseable to end up being enhancing your the place to find make sure your house appraises for the full-value. Delaware loans for bad credit As to the reasons? As appraisal of one’s residence’s really worth will have an enormous part for the deciding the size of your residence equity loan and you will the amount of equity you could potentially tap into. It just is practical to ensure your residence seems the ideal in the event that appraiser involves name. Nevertheless the great are, you don’t need to sink a king’s ransom in the home to appeal your own appraiser. Simple things like laundry carpentry and you may structure, deep-clean up their bedroom, renting a carpet cleaning servers, making the potted plants on the front-porch and you can making certain slight repairs are available can help your residence make the better perception via your appraisal.