When you’re rising prices try cooling , rates are still large, and this places an effective damper towards the Americans’ intentions to buy a property or re-finance their current mortgages. The new absolute matter many residents is wondering contained in this economic climate: Should i pick a property now in the large rates and you can re-finance after, otherwise should i wait a little for prices to fall? We posed practical question to several real estate and you may home loan positives and coaches, in addition to their answers will get wonder your.

If you are considering buying an alternative household or refinancing your existing you to it can help to understand what price you are able to qualify for. See right here today!

Robert Johnson, a professor at the Heider School out-of Business during the Creighton School, highlights you to purchase price and you may home loan price will be one or two number 1 economic products potential homebuyers consider when selecting property, but there is however a life threatening distinction between both.

“Just what of a lot are not able to know is the fact only 1-mortgage rate-can be renegotiated,” states Johnson. “Once a house is purchased, you can’t renegotiate the cost. What this means, i think, is when you notice property you believe is priced beautifully, I’d be much more more likely to pull the brand new trigger than just in the event that mortgage rates are attractive and you may home prices look highest. Inside economic terms and conditions, you have optionality for the remainder of their home loan so you’re able to renegotiate terms. You don’t need to one option that have a cost.”

As well, you can experience most other book benefits if you purchase a home in the modern climate. “Customers who will be in the market when you find yourself rates of interest are higher may have certain gurus that they otherwise wouldn’t, such as for example smaller competition and a lot more settling fuel,” states Afifa Saburi, elderly researcher within Veterans United Mortgage brokers. “As they have the possibility so you’re able to re-finance, potentially more often than once in their fifteen- or 29-season home loan label, they also have the chance to make collateral and you will money.”

As with many monetary concerns, the solution is almost certainly not cut and dried, since it varies according to your debts and pushes outside your own manage. Such as for instance, it’s difficult to take on financial costs in the a financial choice when it’s undecided and that assistance they’ll move.

Regarding whether or not to get today and you will refinance afterwards or follow an excellent wait-and-find approach to , economist Peter C. Earle from the American Institute to possess Financial Lookup says it’s hard to help you predict. “Typically, the fresh rule of thumb is that you to definitely won’t loans unless this new the fresh new financial rates so you can protected was at the very least 0.75% to a single% below the founded price,” states Earle.

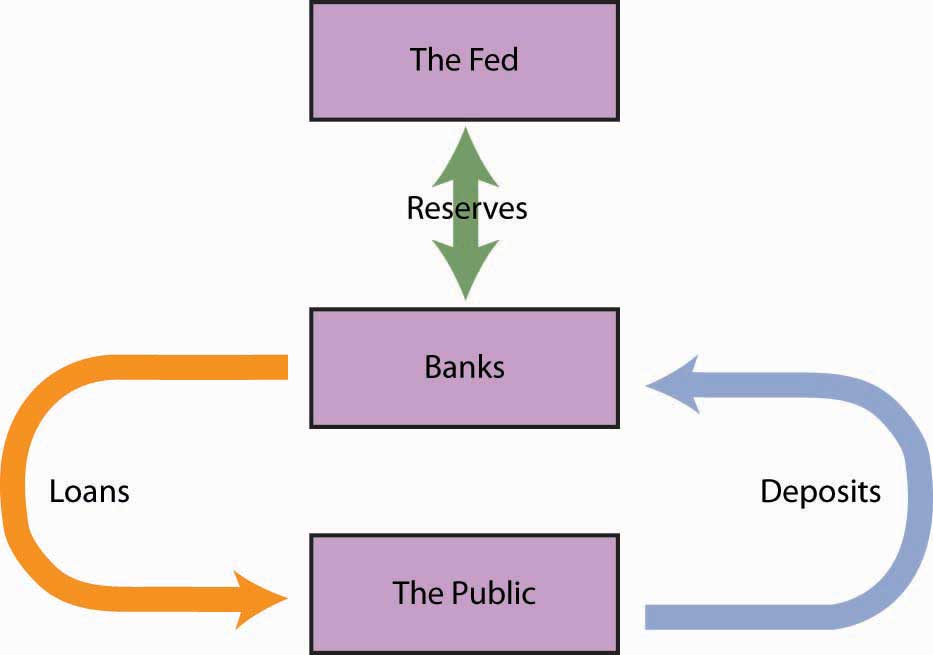

“This new Fed keeps jawboned exhaustively about their purpose to save rates right now levels just after their hiking strategy is more than, however, if the U.S. enters an economic downturn, it is really not after all obvious that they would not get rid of prices. That has been its playbook because Greenspan time,” told you Earle, discussing Alan Greenspan, the former president of your Government Set payday loans online Montana aside of your own United states.

When consumers will be wait until cost miss back off

It does not matter after you buy a home, this new ely, if or not you can afford the fresh new costs as well as how a lot of time you want towards the residing in the home long-term.

Brian Wittman, manager and Ceo from SILT A house and you will Investment, cautions: “I do not have confidence in brand new values one to to buy now and you will refinancing later is the best action to take. We are nevertheless unsure of your assistance of your housing marketplace, along with each other possessions values and rates of interest. The problem using this values is that to order now and you will in hopes one rates of interest go lower to make their payment most readily useful are crappy economic planning. If you’re unable to really afford the percentage now, you’re going to be overpaying as you hold off and you will hope for interest rates to decrease.”

To have current people, the decision to pick today and you can re-finance after , otherwise wait until home loan cost slip, will come right down to your existing home’s home loan rate. “As a whole, I might strongly recommend not attempting to sell otherwise refinancing your home in case the prices try greater than your existing home loan, specifically if you are interested to buy a separate family,” advises Michael Gifford, Ceo and co-creator within Splitero.

The conclusion

If you’ve made a decision to take-out a mortgage today, but i have issues about securing your self into a higher level, imagine delivering a home loan which have a float-off choice. This feature enables you to protected the rate of interest if you find yourself including enabling you to take advantage of a lower price contained in this a particular period.

Uncertain whether or not to pick a home today and you may refinance they later, otherwise wait a little for home loan rates to drop ? It will help to know there are more possibilities worth considering. You to choice is and then make advancements to your house having fun with finance of property equity financing otherwise family collateral personal line of credit (HELOC) . Experiencing your property guarantee so you can upgrade your property will get improve its really worth.